Forewarned is Forearmed:

Lead Time Challenges in the Supply Chain

This past year has posed many challenges for the supply chain, not just from the pandemic but events around the globe. The economy is expanding, and production demand is growing at faster rates than ever before, resulting in extended lead times.

Historic lead times

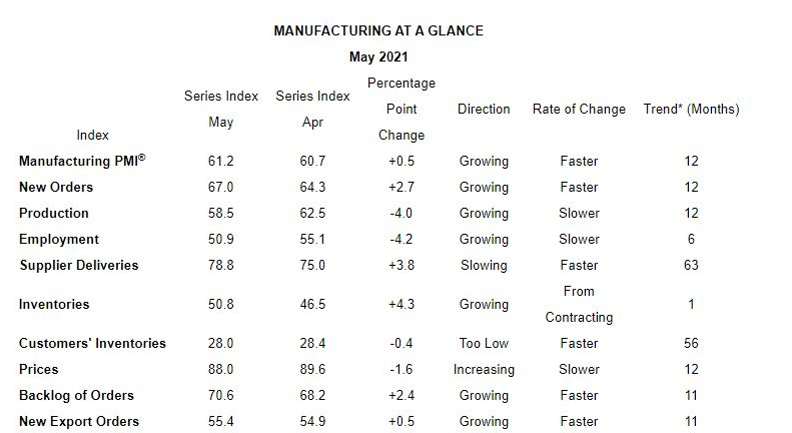

According to the Manufacturing PMI, or the Purchasing Managers’ Index, which is part of the larger Manufacturing ISM Report on Business, manufactures are reporting the longest lead times since 1987, posing a threat to supplier performance including deliveries and quality. This effect on the supply chain is also projected to last well into next year, and manufacturers are having to adjust. The Supplier Deliveries Index, another index within the Manufacturing ISM Report, shows a ripple effect to commodities, the difficulty meeting demand with product shortages, limited transportation, and the price of raw materials rising.

Holiday order delay

An outbreak of Covid-19 in Guangdong province has cause delayed shipments that could cause major congestion on the global supply chain in the coming months, according to BBC. In an effort to control the spread of Covid, one of the main shipping container ports, Yantian International Container Terminal, has been operating at a fraction of its normal capacity since late May. “One of the biggest ports in China has basically closed down for close to three weeks. They have berths in operation, but nowhere near enough.” says Nils Haupt, communications director at the German shipping line Hapag-Lloyd.

“Because the system is so overloaded, every time one of these things happens now, the system is already at breaking point, or past breaking point, so anything else just adds grist to the mill,” explained James Baker, containers editor at shipping industry publication, Lloyd’s List. Mr. Baker continued to add, “One of the issues at the moment, which is aiding the congestion, is the fact that everyone knows that lead times are really slow, so retailers are booking their Christmas goods already.”

Every component is affected

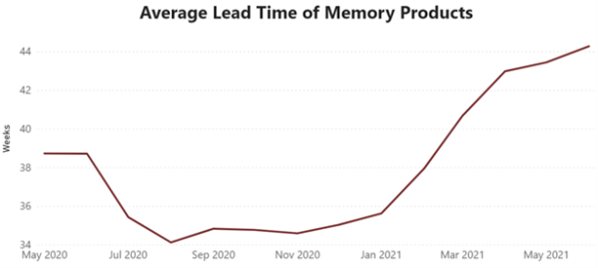

Even with Europe and the U.S markets looking positive as they begin to ease their Covid restrictions, the interconnected supply chain with areas still impacted, such as APAC, are continuing to see tight supply from various components, including memory.

According to Converge’s Memory Commodity Manager, Paul Zecher, “the general IC shortage is contributing to the stability of the memory market. End users can’t build boards and as a result it is pushing out incoming memory shipments.”

Aluminum electrolytic capacitors have also been affected by a surge of demand. The Taiwan-based Lelon Electronics has been at full capacity to fill orders, but lead times are lengthening from its usual 1-2 weeks up to 20-25 weeks. This demand is caused by using excess applications such as power supply units, automotive, healthcare equipment, and servers. The increasingly tight capacity supply is making Lelon Electronics reluctant to take orders lower than gross margins.

How do we deal with extended lead times?

So, what can we do? From a recent webinar hosted by Converge, ‘Obsolete vs. Short: Which First?’ speakers addressed the factors that have led to today’s shortage market and the additional ongoing challenge of managing obsolescence. Many questions asked by the audience began to form a theme: lead time issues.

One question pulled from the webinar was “Have you dealt with or had to deal with a vendor that suddenly changes their lead time, for example from 2 to 52 weeks? What are the options or parts available to you that would otherwise not be available to businesses?” Sam Stephens, Senior Sourcing Manager EMEA at Converge answered, “Depending on the size of your company obviously your escalation process is going to look slightly different. I really think the phrase that is most appropriate is ‘forewarned is forearmed’. If your critical parts list, or for that matter most of your parts, are plugged in with a partner who is constantly analyzing the context of those parts, whether that be lead time, LTB notification or demand in the market particularly – (and that’s the one I would pinpoint as most crucial)- then you’re actually able to get slightly ahead of the curve when shortages run. For instance, if your bill of materials or parts list is shared in advance then with the right partner, you can map activity on those parts in the background. Converge is able to see a huge upturn globally in demand for a particular semiconductor and then map that to other customers actively using it and that is information we can provide potentially in advance of the problem arriving. You can give yourself a buffer to action solutions. Rather than just receiving a call from your franchised distributor or the manufacturer directly advising of a delivery delay, perhaps you have the ability through data sharing to get ahead of the curve which becomes crucial in most instances for saving not only time but also money in the current market with prices being as volatile as they are.”

As a connected distributor, Converge sits at the crossroads of supply and demand. With our deep market knowledge, experience, and connections across the globe, we see the signs and signals of shortages, as well a surplus, before they happen. Our approach allows us to react and advise our customers before pricing, quality, or production are impacted.

Talk to our team about current lead times and solve the future.

Sources:

Lead times for aluminum capacitors prolonged to over 20 weeks (digitimes.com)

https://www.bbc.com/news/business-57446437