Rapid EV Growth Leading to Accelerated Obsolescence

The recent chip shortage reminded those in the industry just how important having a resilient supply chain is, especially to those in the EV market, which lost hundreds of billions of dollars as a result. Despite these challenges, the EV and automotive market remains poised for continued growth. The automotive semiconductor market size, worth $59.7 billion in 2022, is forecasted to triple in size and reach $183.8 billion by 2032. This should come as no surprise considering the White House’s 2030 zero-emission goals and the push for greater sustainability around the globe. However, such rapid growth can come with unintended side effects, namely obsolescence in key components.

The Road Ahead

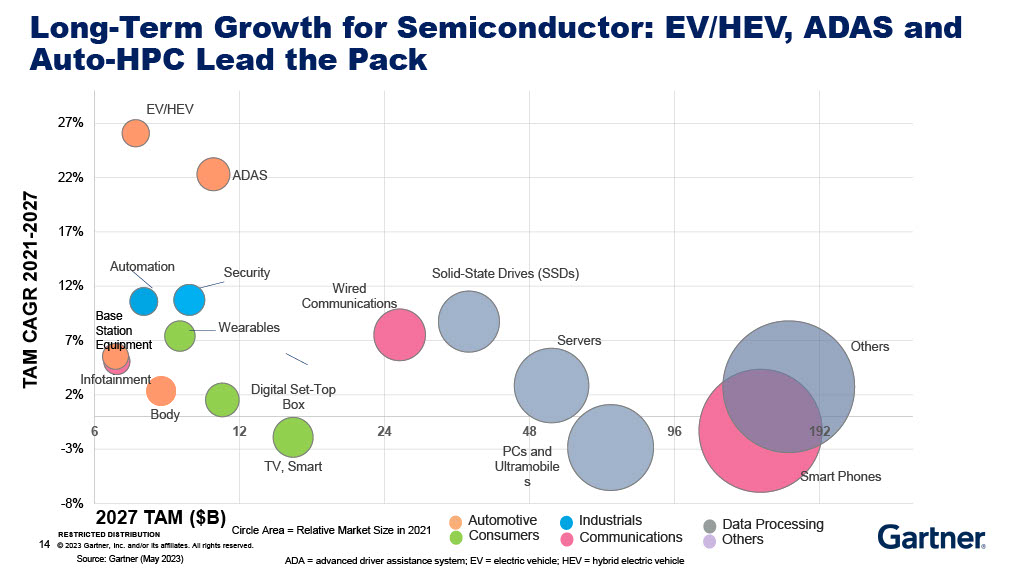

The automotive semiconductor market is predicted to have higher long-term growth than any other semiconductor market by a wide margin. Recently, Gartner analysts predicted the EV market to be leading in long-term growth among all semiconductor markets at approximately 27% by 2027 (See chart above). The market with the second-highest predicted long-term growth rate is Advanced Driver Assistance Systems (ADAS). ADAS is a system used in vehicles that allow for self-driving and accident-avoidance features. Its systems are beginning to develop rapidly in tandem with Artificial Intelligence, as AI serves as the backbone for self-driving technology. Due to the strong specification requirements that AI (and therefore ADAS) need to operate, they require the use of advanced semiconductors. These advanced semiconductors are in high demand to support the proliferation of AI across the technology sector.

Another reason the EV semiconductor market is expected to drastically increase is due to a shif towards using silicon carbide semiconductors over traditional silicon-based semiconductors. Silicon carbide semiconductors can be used in both vehicles and chargers. They enable higher efficiency and power density compared to silicon-based components. Silicon carbide semiconductors not only allow EVs to drive further and more efficiently but they can be used to increase EV charging speeds—EV charging times have historically been a nuisance for owners. As the market continues to shift towards integrating AI technology and silicon carbide semiconductors, these rapid advancements are also an indication of a future onset of more obsolete components.

Reaching End-of-Life

Electronic component obsolescence is a never-ending challenge for the industry. Firms are perpetually discontinuing their least profitable products while focusing on their most lucrative ones. Furthermore, newer and better chips are constantly being developed as manufacturers contend over market control. Obsolescence plays a significant role in the automotive industry; this is particularly true with EVs. According to Bloomberg, China has seen up to thousands of abandoned EVs in empty lots as “they were about to become obsolete as automakers rolled out EV after EV with better features and longer driving ranges.” Abandoning EVs is just one sign of how fast this industry is growing. According to the Wall Street Journal, EVs typically “require more than twice as many semiconductor chips as internal-combustion vehicles.” With the EV market being relatively new, combined with the previously mentioned persistent advances in AI and semiconductor technology, products in this market are reaching end-of-life (EOL) at faster rates. Obsolescence is accelerating and its proper management is becoming increasingly relevant, especially in the EV market. Moreover, the number of electronic components needed in EVs compared to gas-powered vehicles is an indicator that EV manufacturers need end-to-end supply chain solutions and visibility now more than ever.

Green Light to Managing Obsolescence

Supply chains are dynamic and consistently disrupted by both predictable and unpredictable externalities. The electronic component supply chain is cyclical, constantly transitioning from excess to shortage and vice versa. The most recent chip shortage served as a good reminder of this. While the market has settled and now companies are facing more inventory on their shelves, there is a new shortage on the horizon for many EV and automakers — parts going obsolete.

The EV industry is at an advantage by taking the lessons learned from the historic semiconductor shortage of the past few years and applying proactive strategies to combat obsolescence. The need to diversify your supply chain and partner with a distributor like Converge to minimize economic loss and find the right components ensures companies have the resiliency to adapt to dynamic market conditions and further obsolescence.

Converge offers customers an unparalleled value through expert end-to-end supply chain support, inventory management, and electronic component sourcing. We are backed by a global distribution network and belong to a parent company with over 60 legal entities that ships across over 80 countries. Converge leads the charge in obsolescence management, creating customized programs to obtain the components needed as well as managing obsolete inventory to keep production running. In addition, Converge saw the need for better collaboration within the industry and founded the Future of Obsolescence Management (FOM) Community. The FOM community is an international network of individuals and organizations interested in sharing ideas to address present and future challenges in obsolescence.

The EV and automotive industries are impressive examples of the technological advancements the world is making. However, by solving one global challenge, another one is created with the onset of further obsolescence. The need for proactive obsolescence strategies continues to be a key pillar of supply chain resilience.

Contact us to learn more about our obsolescence management programs and the FOM community.